Houston Property Tax Rate Map – Once the property’s assessed value is established, the local government applies a tax rate, known as the millage rate, to determine the amount of tax owed. The millage rate is expressed as a rate . This year we will drop the tax rate $0.0712 from 61.32 cents to 54.2 cents per $100 valuation and lowered overall taxes on existing properties by a little over $145,000. I know in years past folks in .

Houston Property Tax Rate Map

Source : www.chron.com

Harris County home values rise by 6% on average; coronavirus

Source : communityimpact.com

HCAD: Houston ISD

Source : public.hcad.org

Harris County Tax Office

Source : www.hctax.net

Homeowners in Houston do better when they protest property taxes

Source : www.januaryadvisors.com

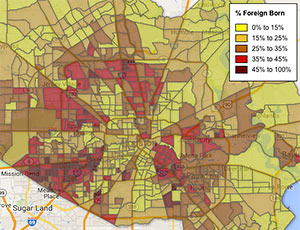

The Future of Houston Is on Hillcroft Now | Swamplot

Source : swamplot.com

Housing Archives January Advisors

Source : www.januaryadvisors.com

Practical Tips to Win Your Property Tax Protest in Houston Steph

Source : www.stradleylaw.com

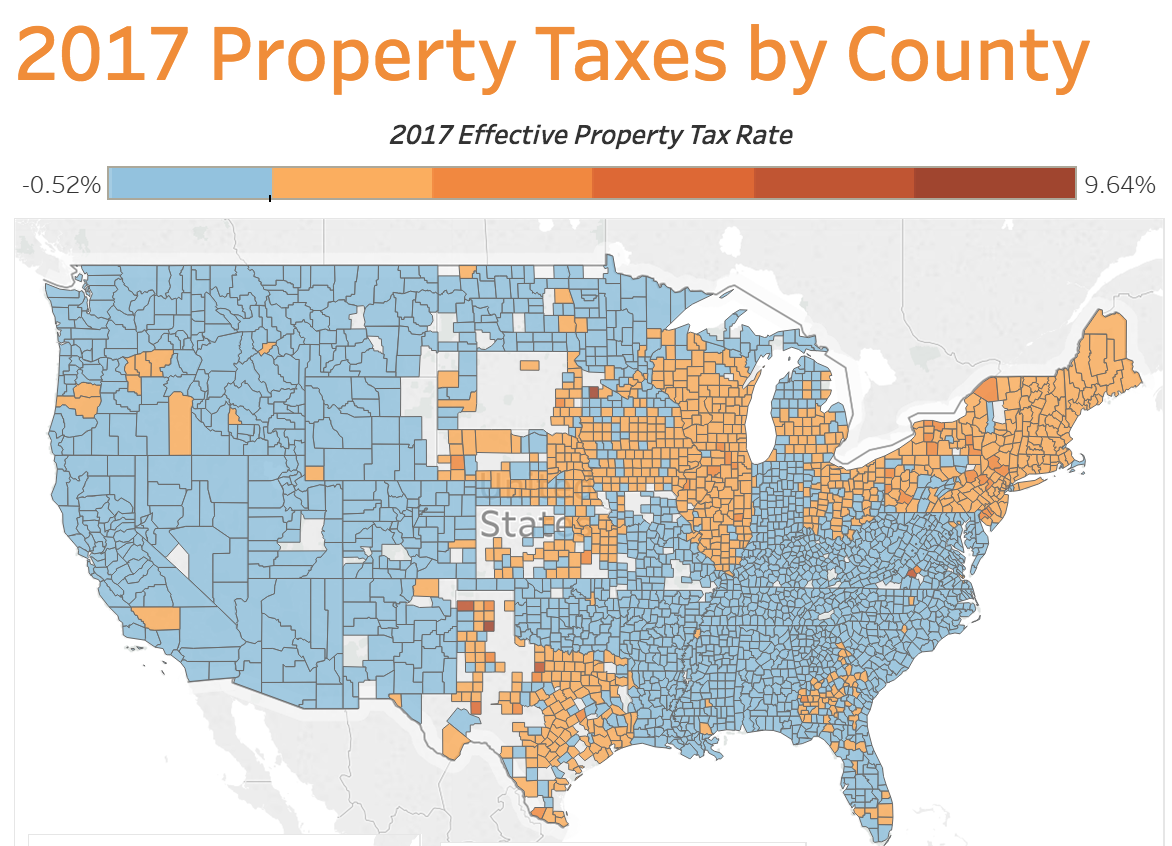

Property taxes on single family homes increase 6% in 2017

Source : www.housingwire.com

Harris County, TX Property Tax Calculator SmartAsset

Source : smartasset.com

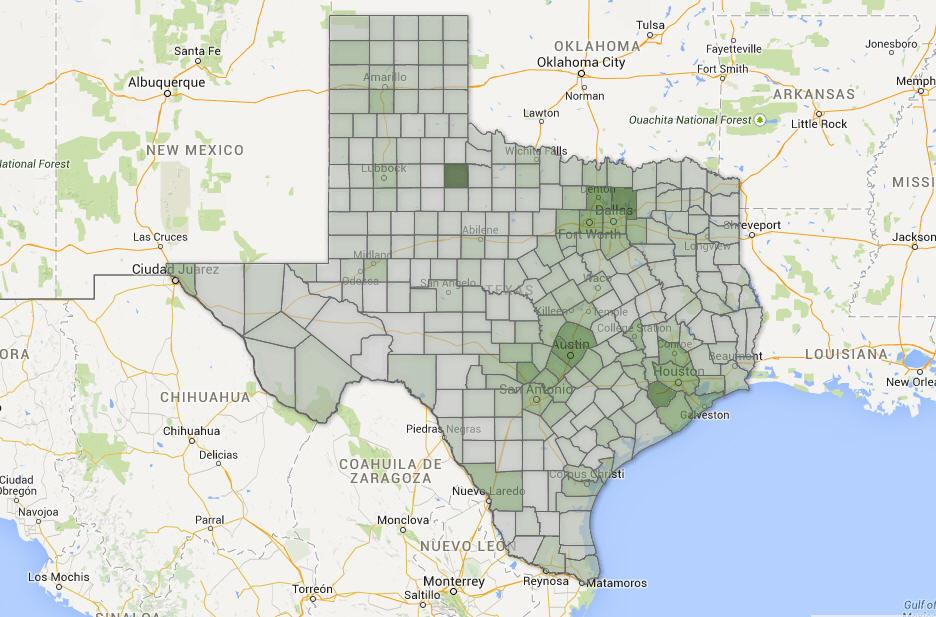

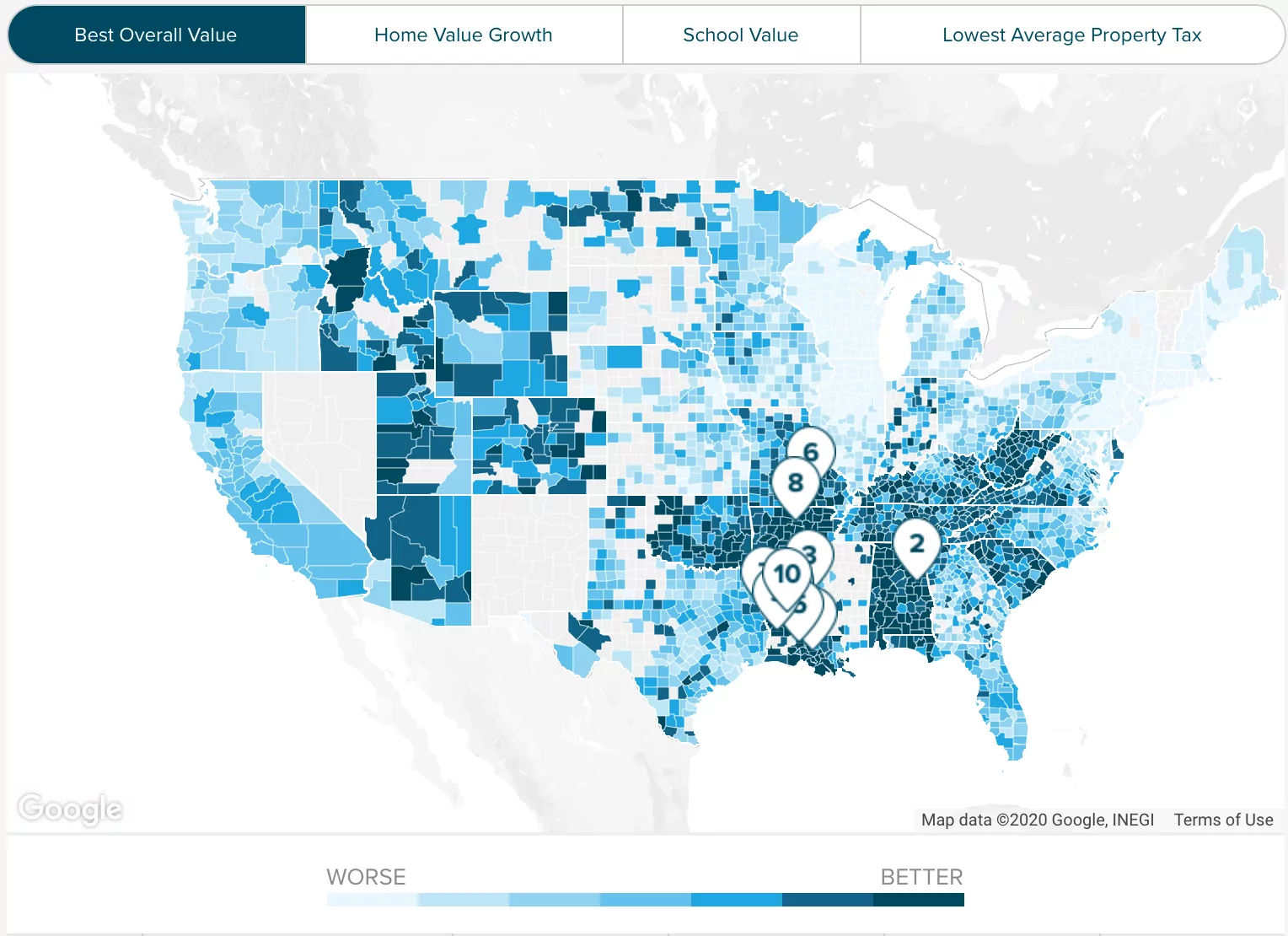

Houston Property Tax Rate Map Houston area property tax rates by county: HOUSTON (KIAH) — Want a chance to lower your annual property taxes this year? You have a chance to if you were impacted by recent storms. The Harris Central Appraisal District (HCAD) is . Property taxes going up in Wilco Nearly every city in Williamson County is looking to raise their property taxes this year, citing growth. Here’s a closer look at the math. .